Sezzle is a payment solution that helps you buy what you need now and pay for it later. They give you the opportunity to pay it back in installments as well, breaking down the total purchase cost into smaller, more manageable payments over time.

As long as you pay on time, there is no interest involved, and you’ll always get text and email reminders before payments are processed.

There are over 40,000 brands to shop from as well as zero impact on your credit.

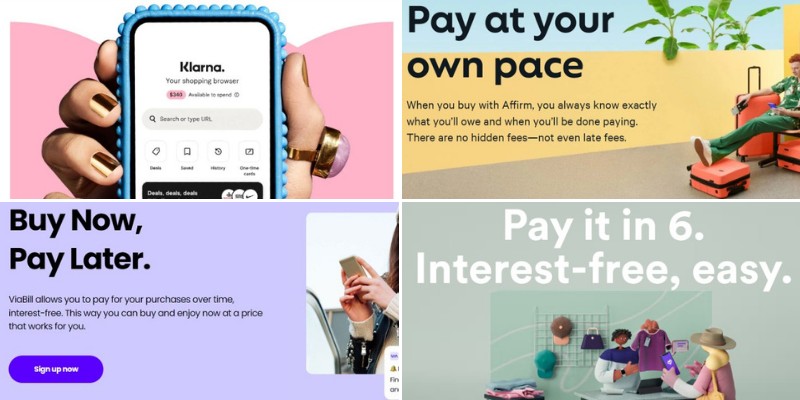

This isn’t the only “buy-now pay-later” payment solution though. So, if you’re curious, check out the following 12 companies like Sezzle below.

Most of the options below offer also apps that you can install on your smartphone to make your shopping experience even better.

1. Venue

Venue gives customers the freedom to choose from over 1 million brand names from their marketplace (with discounted prices), opting to pay over-time with financing.

When you shop with them, you can pay $50 to get your item shipped the same day. Otherwise, you can lease the item out at a discounted rate, making the set amount of payments until it’s yours.

With the lease option, there are no long-term commitments, and you can even send it back if you’re unable or don’t want to pay anymore.

There are stipulations, however, to using Venue. You must have an active checking account that has a minimum of $1,000 of income every month.

Next, you need at least three months of income history with that current income source. Lastly, you must have a government-issued ID, SSN, or a Taxpayer Identification Number.

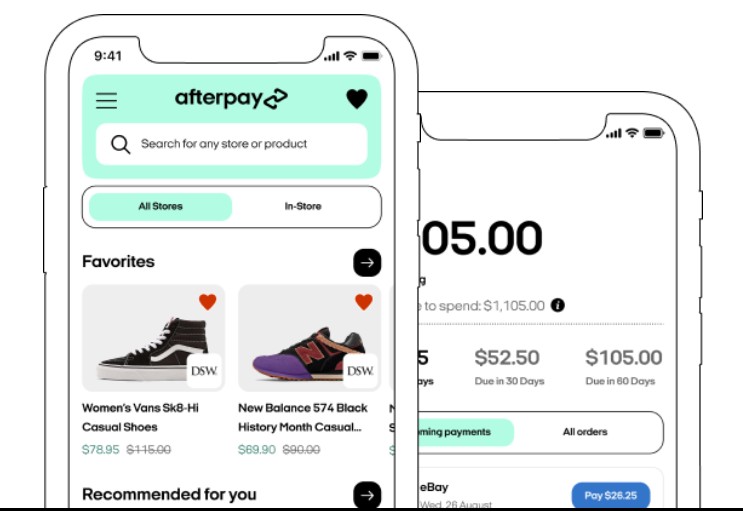

2. Afterpay

Afterpay is a buy-now-pay-later service originally launched in Australia in 2014 and introduced in the U.S. in 2018. Selling over $1 billion worth of products, it remains a top contender in the payment solution marketplace.

During checkout, Afterpay allows you to set up a payment plan split into four payments.

You can make these payments either over two weeks or six weeks, and if all the payments are made on time, no interest is charged. Your first payment is made at checkout.

There’s a minimum purchase of $35 needed to use Afterpay. Also, when you first start out with the company, there’s a maximum placed on you too at $150. This can change after you demonstrate good repayment history.

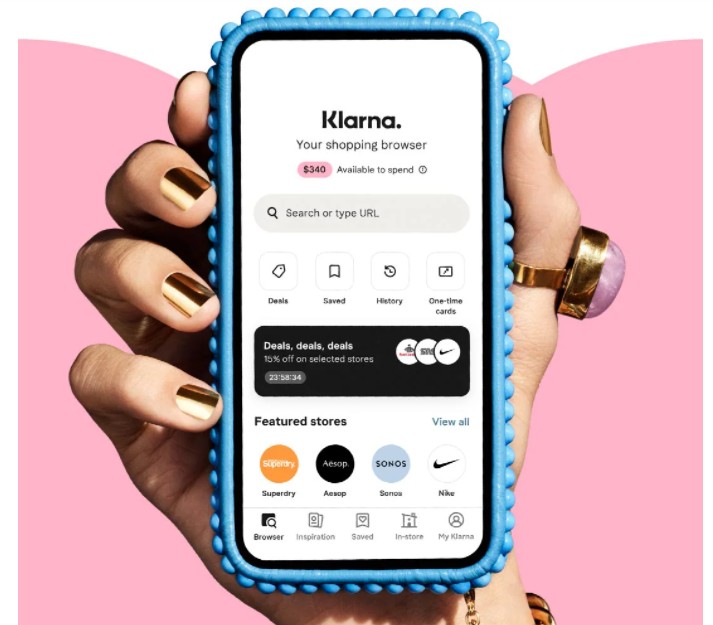

3. Klarna

With Klarna, you get flexible financing for your shopping needs. Once you download the app, you can shop from there, from the official website, or anywhere else Visa is accepted.

There isn’t one set way to make payments, however. Instead, Klarna offers you three solutions:

- Pay in 4

- Pay in 30

- Monthly financing

With “Pay in 4”, it’s interest-free as you pay over four installments. You’ll make your first payment at checkout, while the rest are made on a bi-weekly schedule.

Meanwhile, “Pay in 30” is interest-free as well, and it gives you 30 days to pay off your purchase.

Lasty, “Monthly Financing” you have options to finance your payment within that 6 to 36 months. However, this comes with interests and fees.

4. Affirm

For more than 1000 retailers, Affirm offers a payment solution so that you can buy what you want now, and pay the rest off later.

This popular company works with many famous brands such as Peloton and Purple Mattress.

Affirm works as a short-term loan. Once you apply, you’ll know shortly whether you’ve been approved. The APR will depend on your eligibility and your credit.

You can use their “Pay in 4” method with your payments breaking down in four installments. This won’t impact your credit, and there are no interests or fees charged with this.

Alternatively, you can also use their monthly financing. This gives you more control over when you can pay off your purchase.

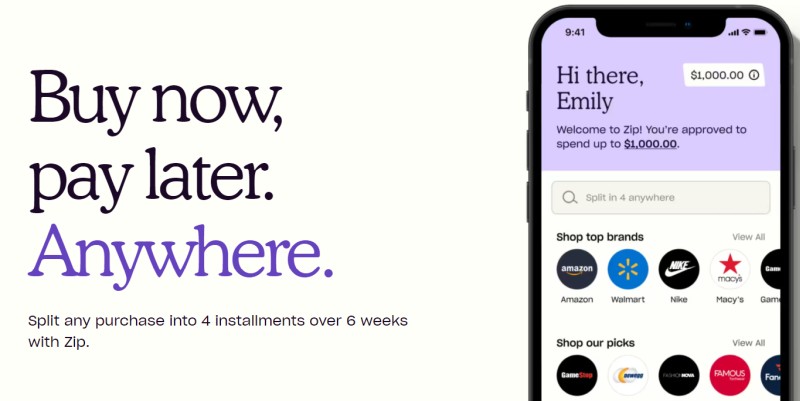

5. Zip (previously Quadpay)

Zip, previously known as Quadpay, allows shoppers to split their purchase down into smaller payments whether you buy online or decide to shop in person.

Purchases are split into four payments with the first due on the date of purchase and the rest over every two weeks.

There’s no minimum purchase set by Zip themselves. However, merchants can decide whether they want a minimum placed on their products.

What Zip does have is a maximum though. Everyone has a spending limit once their account is approved.

Additionally, it’s now known that Sezzle is partnering with Zip in the near future, but what this partnership will fully bring remains unknown as it isn’t happening until later in 2022.

6. Shop Pay by Shopify

Shopify offers people an accelerated checkout method thanks to Shop Pay. This stores information such as your phone number, credit card details, and billing and shipping information.

As such, this is far more convenient for shoppers as you don’t have to input all those details time and time again.

Anytime customers visit a shop that uses Shop Pay, this payment tool recognizes the customer’s information and automatically fills it all out.

Everything is safe and encrypted as well, so when shoppers are ready to check out, they just need to select the buy button and carry on.

Also, you can choose how you want to pay. For instance, you can pay in full or pay over four installments.

7. PayPal Credit

With PayPal Credit, you get a reusable credit line directly connected to your PayPal account. Since this isn’t an actual card, you can only use it with online merchants that accept PayPal.

Thankfully, many major retailers offer PayPal as a payment option in their online stores such as Walmart and Target.

So, if you want something now, but simply don’t have anything in your account, just choose to pay with your line of credit.

As long as your payments of $99 or higher are completed within six months, you don’t have to worry about interest.

Otherwise, PayPal Credit does have a high-interest rate compared to other similar apps and companies.

8. Splitit

Splitit stands out as different from other buy-now, pay-later companies in that there’s no application, credit check, fees, or interest. Instead, it works off the credit cards you already have.

When you use Splitit, it will create automatic payment installments and charge your card over a set amount of months until your purchase is paid off.

However, Splitit can place a pre-authorization hold that is equal to your remaining balance, and this will show as pending on your account.

Be certain you have the right amount of credit available because of this potential hold. Unlike some other companies, you can’t use Splitit for any bill payments.

9. Tabby

With the Tabby app, you can shop some of your favorite stores and pay over installments upon approval.

Your purchases are split across four equal monthly installments that are all interest-free. You can pay things off in four months, or pay within 14 days. This works online and in stores.

Additionally, you can use Tabby to better manage all your payments. Get alerts about your upcoming payments as well as change payment methods.

Via Tabby, you will even notice some weekly updates and information about store discounts, providing you more information to shop for what you love.

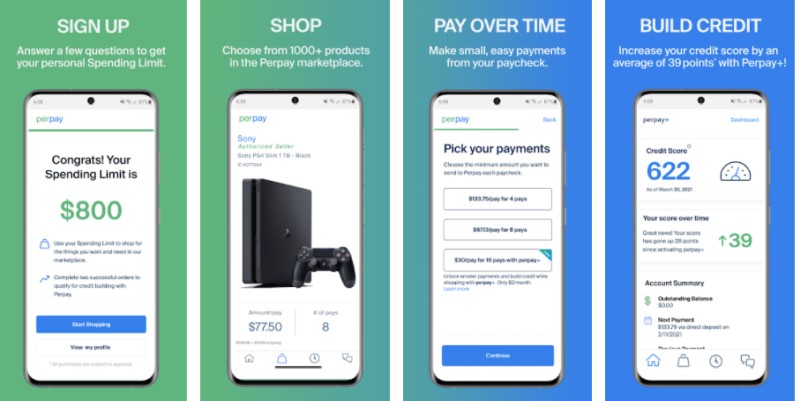

10. Perpay

Perpay allows users to pay over time from some big brand companies such as Apple and Samsung.

This is also a good go-to payment solution if you want more time to pay your purchases as it gives you 12 months rather than the standard 4.

Also, Perpay is a useful method for those with poor or no credit history. This is because they rely on your income rather than your credit score. So, with a good income, you can still have a chance for approval.

The income requirement is the big difference between this and others like it. You must work full-time to be approved for Perpay.

Payments are taken the same time you get paid from your job, so you can find yourself on a weekly, bi-weekly, or even monthly payment schedule.

11. ViaBill

When you use ViaBill at checkout, you’ll pay a down payment, but the rest of the purchase is made in installments over time. As you have to input your email, you will receive a message about your future payment schedule.

For new customers, your installments are due on the same day every month. However, if you’re an existing customer, any new installment will simply be added to the payment schedule you already have.

You get 365 days of no interest. There are also tiers with ViaBill, and if you choose to upgrade from the free membership, you get a host of new features such as extended payment schedules.

12. Laybuy

Laybuy is a New Zealand-based company that makes shopping easier. They do run a credit check before approval, and if you’re approved, your credit line will be based on the report.

You can use this credit limit to make your purchases and pay in installments instead of outright. A part of the purchase price is due when you check out, while the rest is made over the course of five equal weekly payments.

A good thing about Laybuy is that they give you the option to select which day you want your payment schedule to land on. Although there’s just one payment option, there are no interest fees.

Leave a Reply