Like most people these days, I’m a little bit skeptical when it comes to payment plans of any kind.

As tempting as it may be to select one when you come across an item with a higher price tag than you can afford at that particular moment, there are still usually a few concerns to be addressed.

What would the payments be when they’re stretched out instead of being paid upfront?

Could you be getting charged additional fees just for opting into a payment plan?

Well, thankfully I discovered the fact that Zebit is a marketplace that offers thousands of the top brands that we all know and love only you can buy them now and simply pay for them over a period of six months.

In fact, Zebit’s goal is to make both buying and paying for it just as easy as it can possibly be so that you get the opportunity to enjoy a worry-free shopping experience.

However, people want different options in their “buy-now-pay-later” experience.

There are a number of online retailers that offer programs like Zebit. In this article we’ve researched ten Zebit competitors that can be great alternatives, so let’s see them below.

Please note that the ranking below is in no particular order.

1) Venue

Venue has special financing available with no interest but only if paid In full within 6 to 12 months.

It’s a premium marketplace that offers flexible payment options and competitive pricing.

You can shop from some of your favorite stores and then pay over time when you select their SatisFi payment option (synchrony) when you checkout.

Venue Marketplace is currently working with several providers to offer lease-to-own as well as other financing options.

However, all qualifying purchase amounts must be on one receipt.

2) Afterpay

Afterpay is easy to use by simply getting the app, shopping online or in-store, making a down payment, and then making four more payments over six weeks.

However, you may find that to be a rather short time for paying your balance in full. And, late fees and eligibility criteria may apply so you have to be sure to read the fine print.

3) Split it

Splitit lets you pay for your purchases over time prior to accruing any interest. There’s no application to fill out because you’ll be using your existing credit card.

The one drawback with this BNPL plan is that you have to have the full balance of the item price available on your credit card when you make your purchase.

Splitit will guarantee your purchase via a hold on your credit card for the entire time that the total amount remains outstanding.

This is a pre-authorization that will allow you to pay your balance off over time. However, those funds won’t be available to you on your credit card anymore (until paid off) so it’s kind of like borrowing money from yourself.

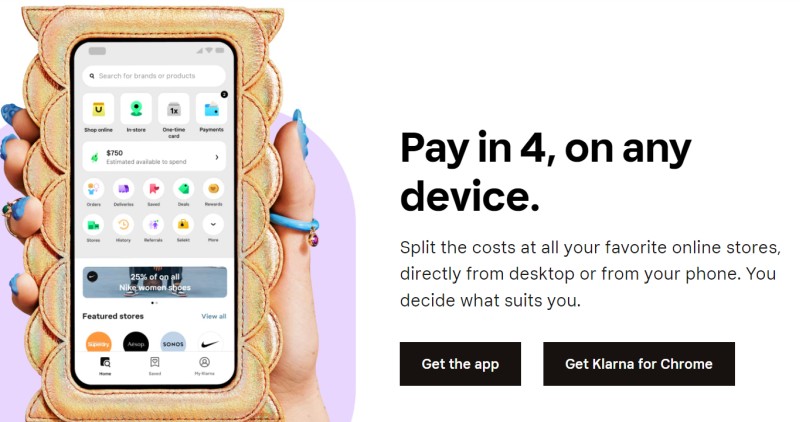

4) Klarna

Klarna allows you to enjoy the flexibility of getting what you want and paying it off over time in four “interest-free” payments.

They are partners with a number of retailers worldwide and offer several payment options, including:

- Direct payments,

- Pay-after-delivery,

- Installment plans (like their Pay-in-4 program).

They provide a handy one-click purchase experience for their customers regardless of how they pay.

Monthly financing is issued by WebBank, a member of FDIC, which basically means that you’re borrowing the money for your purchase, and as you know, that almost always means some kind of interest.

5) Stoneberry

Stoneberry sells everything from electronics and gaming to tools and power equipment as well as everything in-between in their online catalog of products.

And, they offer BNPL with payments as low as $5.99 per month. In addition, there’s no application process since all you have to do is order and click on “Stoneberry Credit” as the payment method when you’re checking out. Pretty easy.

There’s also no annual membership fee, over-limit fees, or fees for paying your bill online.

The only drawback is that you can only order from their catalog and you might notice that some of the prices seem a bit higher than on other sites.

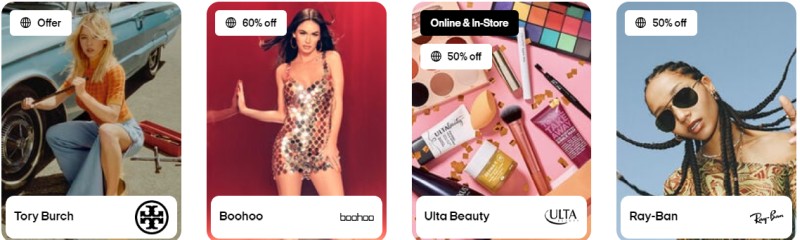

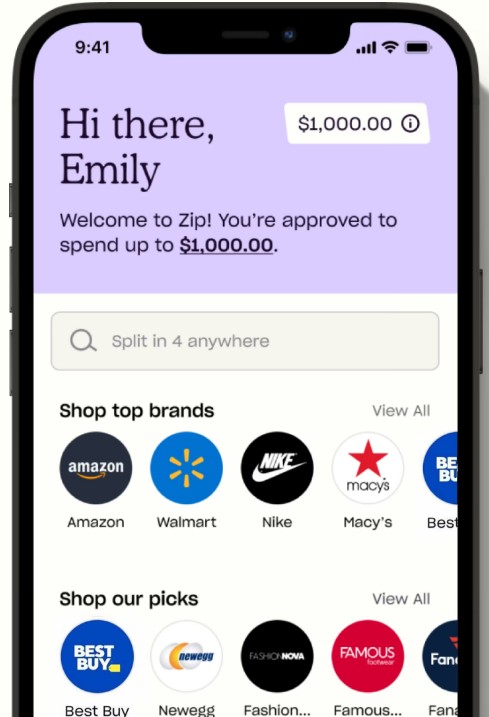

6) Zip

You can split your purchase into four installments over six weeks with Zip. This includes travel, groceries, bill payments, and shopping (both in-stores and online).

This was once called Quadpay and it’s accepted at a multitude of trending stores from Amazon to Walmart and everything in-between.

There’s no impact on your credit score to apply but, again, just like Afterpay, you only get six weeks to pay for your purchases.

7) Affirm

Affirm is touted as being the smartest way to pay over time. You can shop just about anywhere and pay for your purchases at your own pace so that you can get those things that you love without having to break your budget, making it perfect for everyday purchases.

They don’t charge any fees and yes, that includes no annual, late, or prepayment fees, and especially no fees for opening or closing your account.

There is, however, interest charged on their accounts and the rate will be from 10 percent APR to a whopping 30 percent APR (based upon your credit, of course), and this is also subject to an eligibility check.

Affirm payment options are provided by their lending partners. All options depend upon your purchase amount (up to $17,500), and a down payment could be required.

8) Flexshopper

Apply for free for an instant decision, however, FlexShopper is actually a lease-to-own plan (kind of like Rent-a-Center).

Although good credit isn’t necessary, not everybody with bad credit gets approved.

You can browse more than 100,000 products from top retailers including Amazon, Best Buy, Overstock, and more.

And, once you’ve made 52 (yes that was 52!) weekly payments, the product is yours to keep.

Of course, you could also pay it off early. A security deposit and/or down payment may be required.

9) Sezzle

With Sezzle, you can get what you want now and pay over four to six weeks with no interest.

Simply sign up, get an instant approval decision, and shop for more than 47,000 brands.

However, their automated system doesn’t approve 100 percent and it’s possible that your order could be declined (even if it’s less than your spending limit) because Sezzle takes into consideration various factors during their approval process.

And, in addition to individual spending limits, there could also be merchant order limitations. Their minimum dollar amount per order is $35 (including tax and any other fees).

10) Home Shopping Network

HSN’s FlexPay is a payment plan that allows you to pay for your purchases in five monthly installments.

They offer zero percent interest with no hidden fees. Your HSN FlexPay order ships right away, and your first payment will consist of your first monthly installment plus tax and shipping fees.

FlexPay does not report your payments to the credit bureaus, so you can’t build credit with it.

You must be at least 18 years or older, have a valid, government-issued photo ID, and maintain an open and active savings or checking account.

There are a number of items that aren’t available for FlexPay, including:

- Cell phones over $500,

- Coins over $500,

- Computers over $1,500 (including desktops, laptops, and tablets),

- Home protection plans,

- HSN gift cards,

- Jewelry over $1,000,

- TVs over $2,500,

- and more.

More Info About Zebit

Zebit’s buy-now-pay-later plan is a credit system that allows you to pay in installments for your online purchases.

It’s kind of like traditional layaways but without having to wait to receive your product.

When you buy something through their payment plan, your products are shipped out to you just as fast as if you paid for them upfront. You never have to pay in full prior to getting your order.

Here are a few of the other benefits of shopping with Zebit:

- Zebit doesn’t charge any application fees, late fees, membership fees, or even any interest.

- At the Zebit Market eCommerce store, you can use your spending limit for buying all kinds of quality name-brand products.

- Zebit Market carries products ranging from appliances to computers and other electronics, furniture, home goods, health equipment, kitchenware, and all kinds of accessories.

- Zebit Market is constantly updating its product lines.

- All of the products are brand new and in the original packaging.

- Zebit Market will always clearly mark any open-box or refurbished items that are offered at discounted prices.

Leave a Reply