Apps and services like Brigit and MoneyLion allow you to quickly borrow money before your paycheck arrives. However, not everybody may like these options so many people look for alternatives.

Brigit is free to use but there is a “Plus membership” plan with advanced features that costs $9.99 per month. Likewise, MoneyLion may repel many people with its APR of 5.99% to 29.99%.

If you like the idea of these financial apps but aren’t quite fond of their terms, then we have 15 alternatives to offer.

The 15 showcased apps below have distinct features and terms, so hopefully by the time you are done with this post, you will know which app/service would be the best for you.

1. Earnin

Earnin isn’t exactly a loan app – rather than provide loans for interest, it allows you to access your salary earlier than the payday.

With that, Earnin and similar apps can provide you with financial assistance in case you urgently need money right before your paycheck arrives.

Earnin allows you to cash out up to $100 per pay period. What’s even better is that Earnin has no fees – no commissions or subscription costs. Instead, this platform relies on tips. You are allowed to choose how much to tip to Earnin, which may be even $0.

When your paycheck is direct deposited, Earnin deducts the amount that you’ve cashed out. So yeah, this is how Earnin offers early access to your earnings.

Additionally, Earnin allows you to set up alerts that notify you when your bank balance falls below $0-$400, which can help you be more efficient with your money.

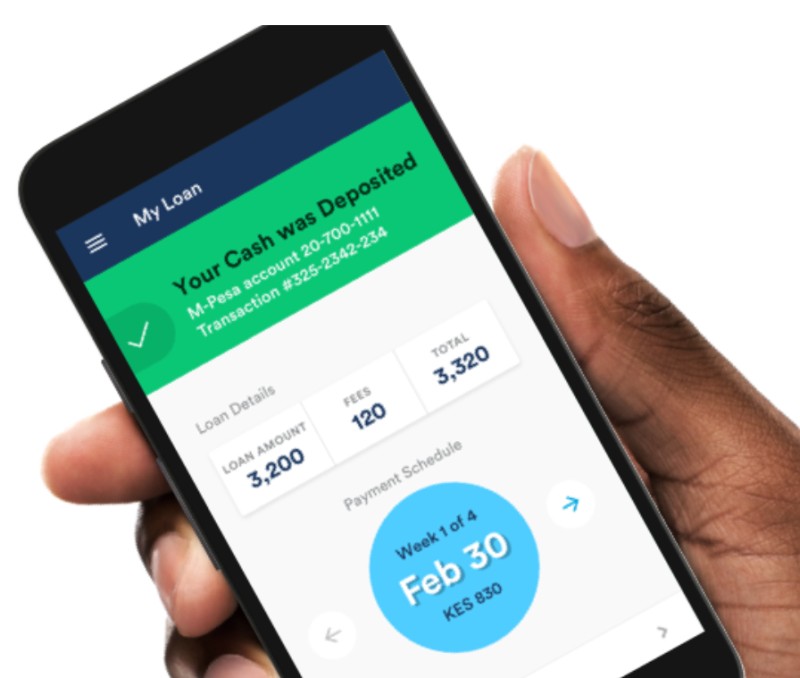

2. Branch

Most services and apps on this list are focused on the US, but what if you are in a country not serviced by the likes of Brigit, Earnin, or MoneyLion?

Well, those living in Kenya, Tanzania, Nigeria, Mexico, and India can make use of Branch. Branch provides loans for up to 48 weeks with a monthly interest rate.

The interest rate varies based on the location, so make sure to check it out. All loans can be requested and received online from your smartphone.

Unlike Earnin, Branch is focused on more classical loan services. That’s why the cost of Branch is a little higher.

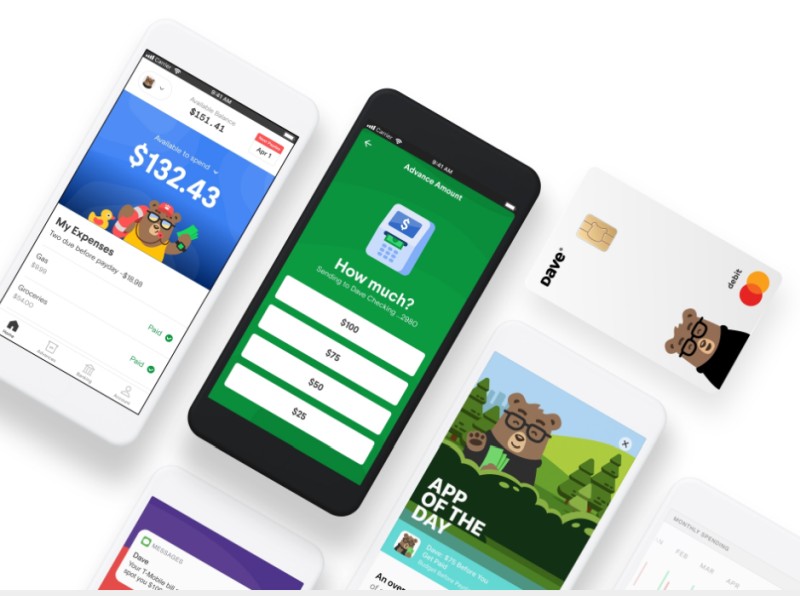

3. Dave

Dave is like Earnin – it allows you to access your salary earlier than the payday, with up to $100 payments. At its basics, the two services are identical, but there are some notable differences that may make Dave more appealing to you.

Most importantly, Dave has partnered with LevelCredit to report your loan payments to major credit bureaus. This means that you can build or improve your credit score with Dave.

Another notable difference is that Dave costs $1 per month to use. This isn’t too much though, so we don’t think that the paid membership will repel many people from Dave.

4. PockBox

PockBox allows you to receive up to $2,500 loans with monthly interest, so it’s again a more classical loan service.

With that said, there’s one important thing to note with PockBox – it doesn’t provide loans by itself but merely connects you with lenders.

Thanks to this, you have more flexibility in choosing a lender. Not only that, but you get access to lenders who are willing to provide loans even to those with bad or no credit scores (though possibly with higher interest rates).

On the flip side, we can’t really tell how much interest you will have to pay – this all depends on the lender. You will have to do some digging on your own to find that out.

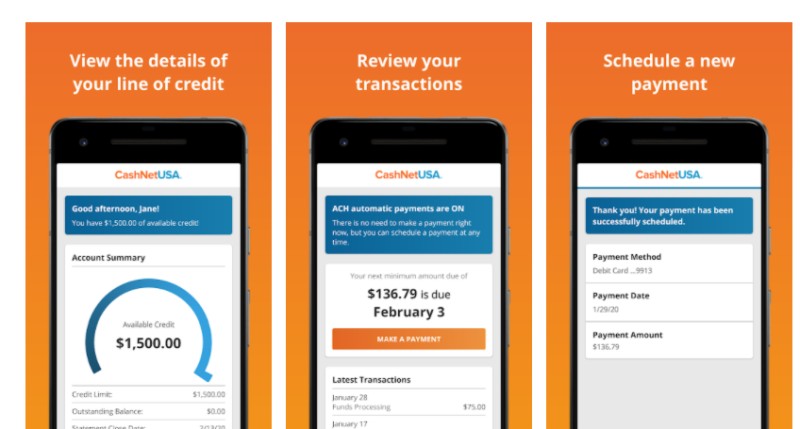

5. CashNetUSA

CashNetUSA offers payday and installment loans throughout the United States. The rates & terms of loans vary from state to state, so you will have to have a look at CashNetUSA’s website yourself.

Payday loans are the central service of CashNetUSA. Typically, CashNetUSA loans are to be repaid upon your next payday, though in some states, loan extensions may be allowed too.

One of the greatest things about CashNetUSA is that you can borrow a loan regardless of your credit score. However, CashNetUSA doesn’t report loan information to Experian, Equifax, and TransUnion, so your FICO score will not be affected. As they say, there are always two sides to everything.

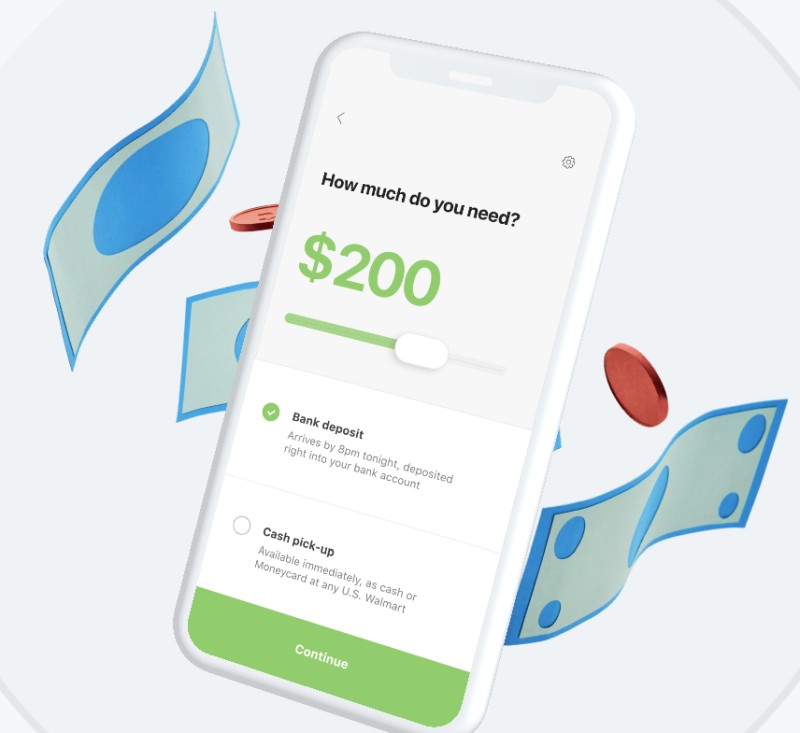

6. Even

Even is partnered with employers throughout the United States to allow for early access to wages. Basically, the service allows you to get early cash payments that get deducted from your paycheck. With that, Even is a lot like Earnin, but its terms are a little different.

Even offers access to on-demand payments as often as you want, but for an $8 payment per month. $8 per month isn’t a lot, especially if you will be requesting payments frequently throughout the month.

But if you think that $8/month is a lot for your volume of money, then we have a few other similar options down the list.

One thing to note with services like Even – your employer needs to be partnered with the service. You will have to check with your employer whether Even payments are accessible to you.

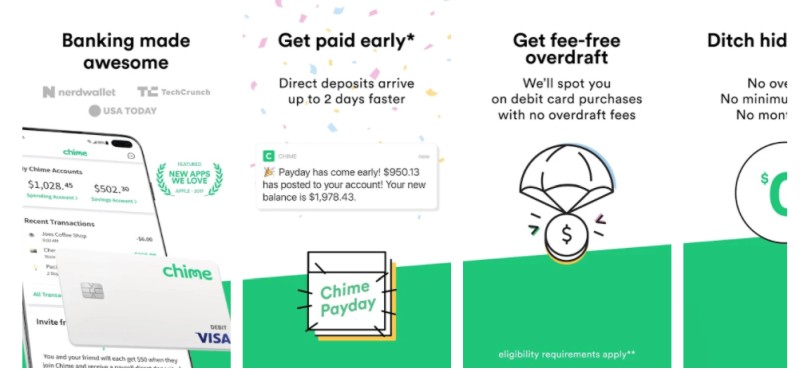

7. Chime

If you like the model of Earnin or Dave more than Even, then another good alternative is Chime. Like Earnin and Dave, Chime gives out early wage payments, but it works in a somewhat different way.

If you decide to work with Chime, then you will get a Visa Debit Card, plus a Spending Account. Chime has a network of over 38,000 ATMs throughout the United States, through which you may withdraw up to $500 daily without any fees.

Chime makes money via interchange fees that incur with every card transaction. However, the service is free to use for you.

Note that if you withdraw money from an ATM that is not part of Chime’s ATM network, you will be charged $2.5 per payment. But given that Chime is integrated with 38,000 ATMs, you should be able to avoid this fee quite easily.

Another thing you may do with Chime is save money, which may be done via an optional Savings Account.

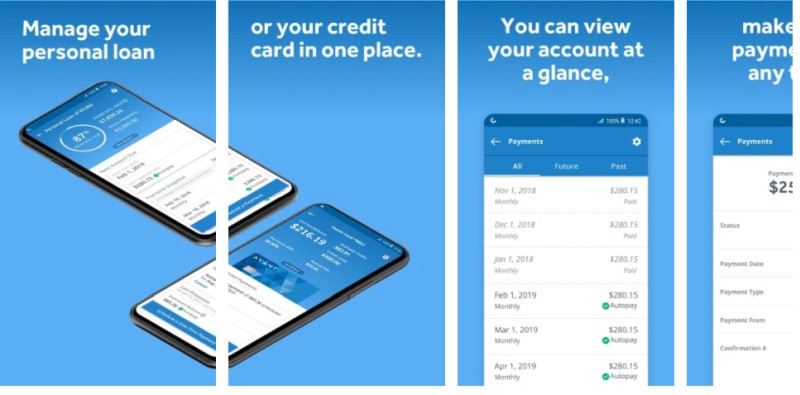

8. Avant

Avant offers two kinds of services:

- Credit cards with $300 to $1,000 credit limits with 24.99%-25.99 APR. This service has an annual fee of $29-$59.

- Secured and unsecured personal loans.

Secured loans are loans that are secured with your car. Using your car as collateral, you get access to more favorable terms and quicker loan approval.

The precise rates and terms depend on your state. But generally, here are the terms of Avant:

- Loan amount from $2,000 to $35,000 for unsecured loans and $5,000 to $25,000 for secured ones.

- 24-60-month duration for unsecured loans, 24-48 months for secured loans.

- Administration fee of up to 4.75% for unsecured loans, 2.5% for secured loans.

- APR from 9.95% to 35.99% for both secured and unsecured loans.

9. Varo

Varo is one of the most complex and comprehensive online financial platforms we’ve seen. Its offering consists of:

- Bank accounts.

- Savings accounts.

- Checking accounts.

The bank account portion of Varo services is pretty interesting – it offers:

- No fee overdrafts up to $50.

- No monthly fees.

- No withdrawal fees at over 55,000 ATMs.

- No foreign transaction fees.

- No transfer fees.

Aside from that, Varo provides $3,000 to $25,000 personal loans with terms from 3 to 5 years. The APR is fairly low – from 6.9% to 23.9%.

Have in mind that Varo does perform credit checks for loans, so loans with this service may not be accessible to everybody.

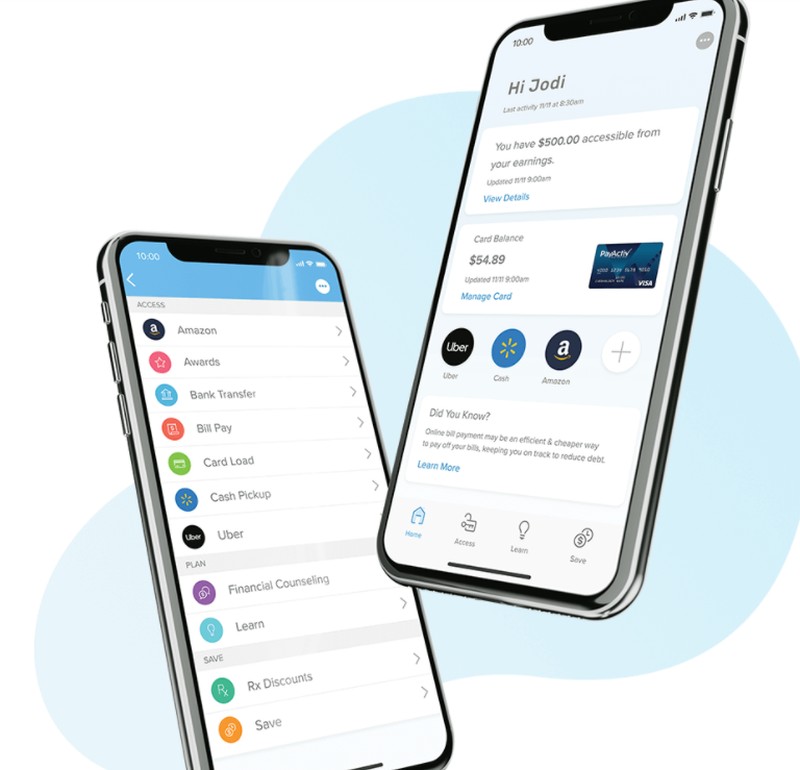

10. PayActiv

Remember Even? Well, PayActiv works a lot like Even – it has partnered with employers throughout the US to allow workers to access their salaries early.

Likewise, all withdrawals are deducted from your paycheck. Additionally, not every employer may be partnered with PayActiv, so you might not be able to access it.

Despite the nearly identical basics, PayActiv and Even have slightly different terms.

PayActiv allows you to withdraw up to $500, and you are charged $5 bi-weekly. However, you are only charged the bi-weekly fee if you use PayActiv – otherwise, you won’t have to pay anything.

With that in mind, PayActiv may be a little more cost-effective for you than Even. Even, in contrast, would be a little cheaper than PayActiv per month if you were to request money often.

With that said, also keep in mind that some employers may work with only one of these two platforms. So aside from the costs, consider the availability of the service too.

11. Digit

Digit is quite a bit different from all other services on this list. This is because Digit is aimed at helping you save money.

We’ve already seen loan services that had optional savings features, but Digit is the first one on this list to be solely focused on savings.

Here’s how Digit works – it analyzes your spending and automatically transfers money from your checking account to the Digit wallet when you have leftover money. Once every 3 months, you also get 0.5% savings bonuses.

The greatest thing about Digit is that it, unlike traditional savings accounts, adapts to your spending automatically and saves money without your input. All Digit accounts are also FDIC-insured up to $250,000, so your money should be safe.

The cost of using Digit is quite low – only $5 per month. While Digit doesn’t provide you with access to payday loans or early salary payments like previously featured apps, it allows you to accumulate money over the long term – great if you have positive net income.

12. Empower

Empower offers a more affordable experience than traditional checking accounts. The core benefits of Empower are as follows:

- APY of up to 0.25%.

- No overdraft fees.

- No card replacement fees.

- No minimum deposit amounts.

- Only 1% transaction fee.

- 3 ATM fee reimbursements per month.

Aside from these features, Empower also offers automated savings, budget tracking and alerts, smart saving recommendations, and up to $150 cash advances.

Cash advances are provided without credit checks and have no fees, although Empower does take into account the average monthly direct deposits and other factors when assessing the eligibility of applicants.

Empower isn’t free, unfortunately – it costs $8 per month, with your first 30 days being a free trial.

13. Stash

Stash’s platform offers a wide range of services – most importantly, up to 2 days earlier paydays. If your employer or benefits provider notifies Stash of an incoming deposit, Stash may provide you with early access to your money.

And interestingly, if you direct-deposit more than $300 within 30 days, you will be provided with $50 to invest.

Speaking of investments, they are a unique feature of Stash. If you make purchases with the Stash Debit card, you will be provided with stock.

This feature is called Stock-Back – typically, Stock-Back is 0.125% on your purchases and up to 5% at certain merchants.

Stash provides you with access to Roth and Traditional IRA accounts as well.

Stash is quite inexpensive too – from $1 per month. The cheapest Beginner plan provides you with access to Stash’s essentials, but with the higher-tier Growth ($3/month) and Stash+ ($9/month), you get things like tax benefits for retirement accounts and 2x Stock-Back.

14. SoLo Funds

SoLo Funds allows you to borrow loans up to $1,000 with 14-30-day terms. As a platform that connects you with lenders, SoLo Funds doesn’t put forward any rates or terms – these are to be agreed between you and the lender.

Speaking of lenders, what’s interesting and unique about SoLo Funds is that it allows you to lend funds as well! So this is not only a loan platform but also a money-making platform.

15. LendUp

Finally, we have LendUp.

LendUp offers its services in only 7 US states, and its terms & rates differ depending on where you are. But generally, for first-time users, loans are limited to about $250 and have 7-30-day terms. The APR varies, but it ranges from 100%-200% to 1,000% and sometimes even more.

LendUp doesn’t require a good credit score to issue loans, so the high APR isn’t that repelling. And if you happen to reside in California, Louisiana, Mississippi, Missouri, Tennessee, Texas, or Wisconsin, LendUp may be an excellent money borrowing option.

Leave a Reply